Team Estrade, Writer, Estrade

India Inc. is anxiously looking forward to the GST implementation scheduled on July 1, 2017. This is a revolutionary change in the way India Inc. conducts its business across the country. It is aimed it decreasing unnecessary hassles and loss of revenue for all stake holders involved. Team Estradespoke to India Inc. on their views for the GST roll out on July 1, 2017.

Rakesh Reddy, Director, Aparna Constructions & Estates Pvt Ltd. “One of the longest awaited tax reforms, GST, is slated to come into effect from 1st July 2017. This will subsume a whole host of indirect taxes such as excise duty, VAT/CST, service tax etc. The GST council has brought real estate under the GST ambit partially through the works contract and will be taxed at 12% under GST. Currently, the end user or home buyer pays taxes anywhere between 9-11% including service tax and VAT and excluding stamp duty. So the net impact on the homebuyer may be neutral or may go up marginally. However, if there is no abatement of land cost, which currently is not yet clear under the GST regime, the cost to the home buyers may go up.

Also, with the exemption of service tax on affordable housing not being continued under GST, the prices in this segment may also go up marginally.”

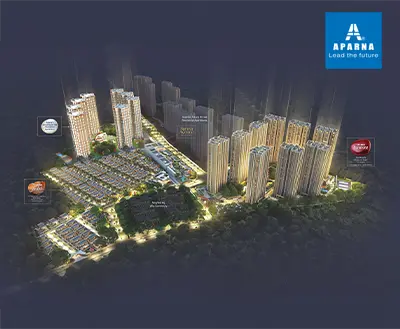

Aparna Constructions & Estates: Aparna Constructions & Estates is a leading real estate developer from Hyderabad which started its operations in 1996. So far Aparna has completed and delivered 36 projects comprising fully-integrated gated community villas, premium apartments, commercial projects, residential plot projects spread across 18 million square feet.

LINK